11+ Sales And Use Tax Certificate Background

11+ Sales And Use Tax Certificate Background. Tax certificates for multiple states. This verification does not relieve the vendor of the responsibility of maintaining a copy of the certificate on file.

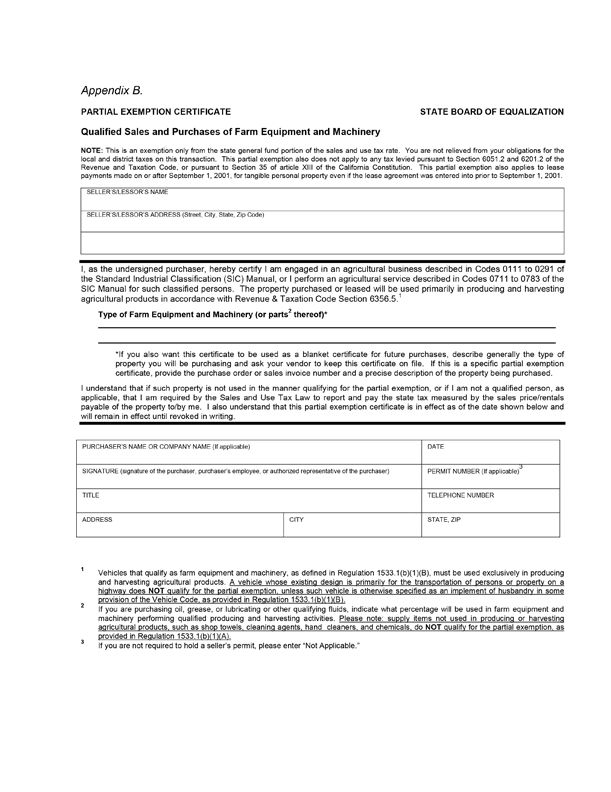

While in some jurisdictions your organization must expressly getting sales tax exemption certificates.

A business which is registered for sales and use tax can use a resale certificate only when the merchandise being purchased is to be resold by any merchandise obtained upon resale certificate is subject to use tax if it is used or consumed by the purchaser in any manner, and must be reported. When the applicable tax would be sales tax, it is the seller who owes that tax unless the seller takes a timely and valid resale certificate in good faith. Exemptions from sales and use tax are frequently available to resellers, nonprofits, and others. Visit sales and use tax on motor vehicles for more detailed information.