Get Sales Tax Exemption Certificate Iowa Background

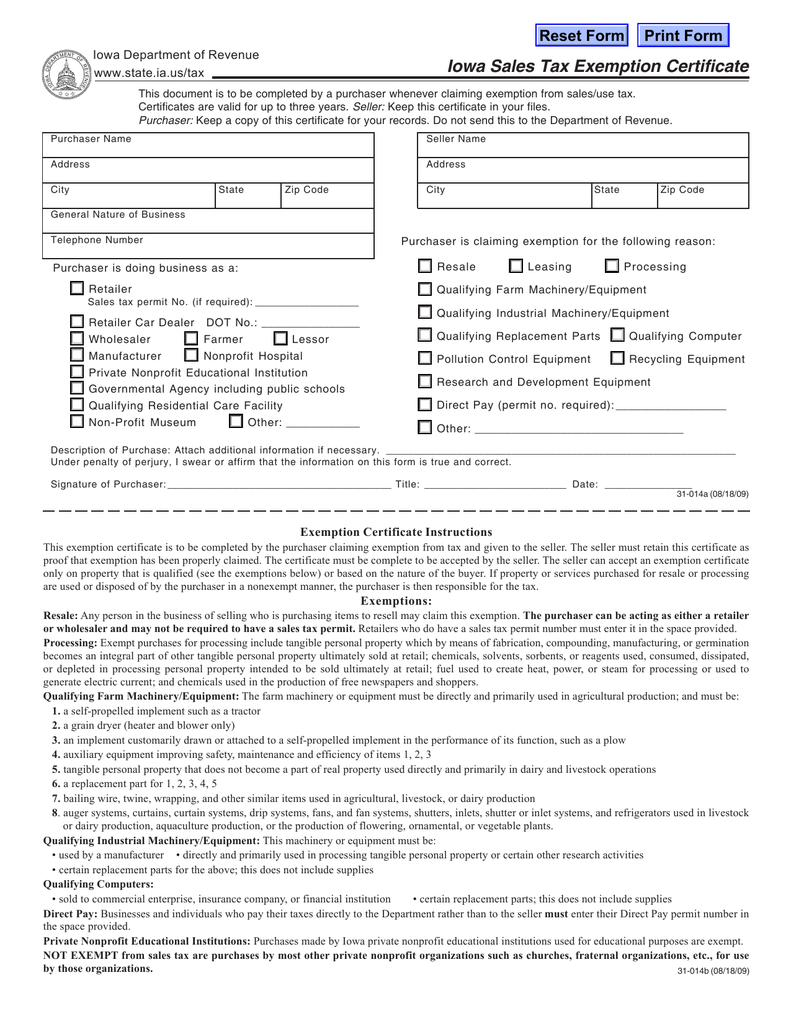

Get Sales Tax Exemption Certificate Iowa Background. Instructions this exemption certificate is to be completed by the purchaser claiming exemption from tax and given to the seller. An iowa sales tax exemption certificate is required when normally taxable items or services are sold tax free.

In this video, i talk about the certificate of authority and getting sales tax exemption!

To qualify for exemption, a tax exempt/reseller customer will need to provide vistaprint customer service with the receipt received at the end of the order and proof of tax exempt status (e.g. Taxation and finance, department of state. Sales and use tax exemption for purchases of vessels docked in connecticut for 60 or fewer days in a calendar year. © copyright iowa department of revenue | iowa web design provided by webspec design.